open end lease meaning

Typically an open-end lease is cancelable by the lessee after a minimum period with the lessee. Normal wear and tear is typically more stringent with a closed-end lease compared to an open-end lease.

Here S How To Lease A Car Lendingtree

Monthly payments are usually lower than the grant of hired purchase the purchase lease requires large payments when maturing.

. Leasing is straightforward. Open-ended leases allow landlords and tenants to change the conditions of their lease agreements with a 30-day written notice unless otherwise specified. While an open end lease is set up so that the risk is largely associated with the lessee a closed end lease is generally situated as to have the risk be assumed by the leasing company.

For example if your lease early termination payoff is 16000 and the amount credited for the vehicle is 14000 your early termination charge will be 16000 minus 14000 or 2000. If the realized value is greater than the residual value the lessee may receive the. The most common type of car lease also known as a closed-end lease.

Unlike a closed-end lease where. Most closed-end leases also have mileage restrictions between 16000-24000 kms per year. Auto leases available to consumers fail into two categories - open-end operating leases and closed-end operating leases1 Under an open-end lease the lessee ie the consumer assumes risk regarding the market value of the leased auto at lease expiration.

An open-ended lease is generally used for commercial business leasing and is sometimes seen in other high-risk leases such as for motorcycles. Open-end leases are generally blanket or master leases with multiple takedowns of equipment. This type of lease means that you the lessee are responsible for the difference between the estimated residual value of the leased vehicle and its true market value when its time to turn the car.

Amount credited is frequently about 5 percent below the wholesale value of the vehicle. This means that you could potentially owe more money should your car depreciate. Open-end leases also exist and are most often used in the case of commercial business lending.

The amount that the dealership will credit you for the vehicle you provide as partial or full payment for another vehicle. A lease providing for increases in rental payment at specified dates. We asked lessors at three fleet leasing and management companies to dig a little deeper into both to help you determine the lease that works.

Open-end leases have flexible structures that are as close to vehicle ownership as possible only with the additional benefits of leasing. In contrast to a closed lease contract. They normally involve portable or mobile equipment that is clearly not special purpose to the lessee eg automobiles or other fleet-type vehicles.

A closed-end lease that is typically written for a contractual term of two to three years would require a larger amount on the balance sheet assuming the fleet does not believe there is an obligation to take on. This works well for employers since the cost of the vehicles can be written-off or. In an open-end lease you may receive a refund of any gain and you are responsible for any deficiency.

An open-end lease containing a 12-month term that then goes month-to-month would require 12 months of payments on the balance sheet. What is an Open End Lease and Closed. Open-end leases are typically less expensive than closed-end leases but they also come with more risk.

The lease contract usually a car or means of transport in which payable payments completely debt. Bear in mind though that the flexibility can come at a cost to the lessee. A closed-end lease is a rental agreement that puts no obligation on the lessee the person making periodic lease payments to purchase the leased asset at the end of the.

There are no mileage restrictions or penalties and the vehicle s can be returned at any. The open-end lease definition connects the two parties involved - the lessee and the lessor - through a rental agreement also known as a finance lease. If you rack up the miles on the leased car or cause some damage then you could be paying for it at the end of the lease term.

However youre responsible for the cars residual value at the end of the lease. There are benefits attached to leasing including tax deductibles getting hardware replaced if it breaks down and getting potential upgrades at the end or. However with an open-end lease the terms are generally more flexible.

According to Credit Karma an open-end lease has flexibility when it comes to mileage limits and lease terms. Youre given a contract with set specifications but the basics involve you paying a flat monthly rate in exchange for use of the equipment loaned to you. This payment scale is public when the lease terminates.

In a closed-end lease the lessor assumes the depreciation risk but the terms are more restrictive. The employer takes all the financial risk. A companyemployer will assume management and leasing of the car to its employees not the leasing company.

However the lessee is responsible for paying for any damages at the end of the lease that go beyond normal wear and tear. What does an Open-End Lease mean. Regulation M the term open-end lease means a consumer lease in which the lessees liability at the end of the lease term is based on the difference between the residual value of the leased property and its realized value.

The risk in this case is really referring to the potential for commercial equipment items to depreciate in value over the. The terms include a minimum 12-month lease technically 367 days followed by a month-to-month structure. Very simply in an open-end lease the lessee assumes the depreciation risk but has more flexible terms.

A lease in which the lessee guarantees the lessor the difference between the residual value of the leased asset and the value realized from the assets sale at lease termination is an open-end lease it thus exposing the lessee to residual value risk. An open-end lease is a lease contract that provides a final additional payment on the return of the property to the lessor adjusted for any value change.

How To Lease A Car Credit Karma

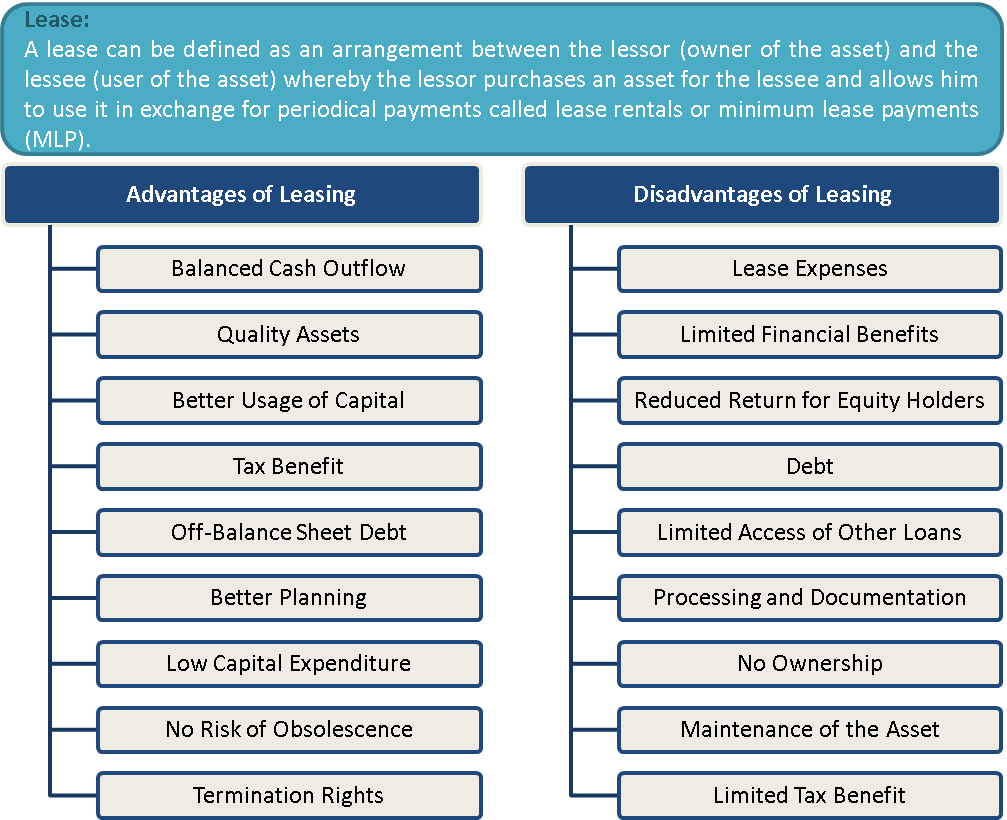

What Is Leasing Advantages And Disadvantages Efinancemanagement

Can I End My Car Lease Early If I Become Disabled Bankrate Com

Open Vs Closed End Leases What To Know Credit Karma

Top 27 Lease Agreement Clauses To Protect Landlords

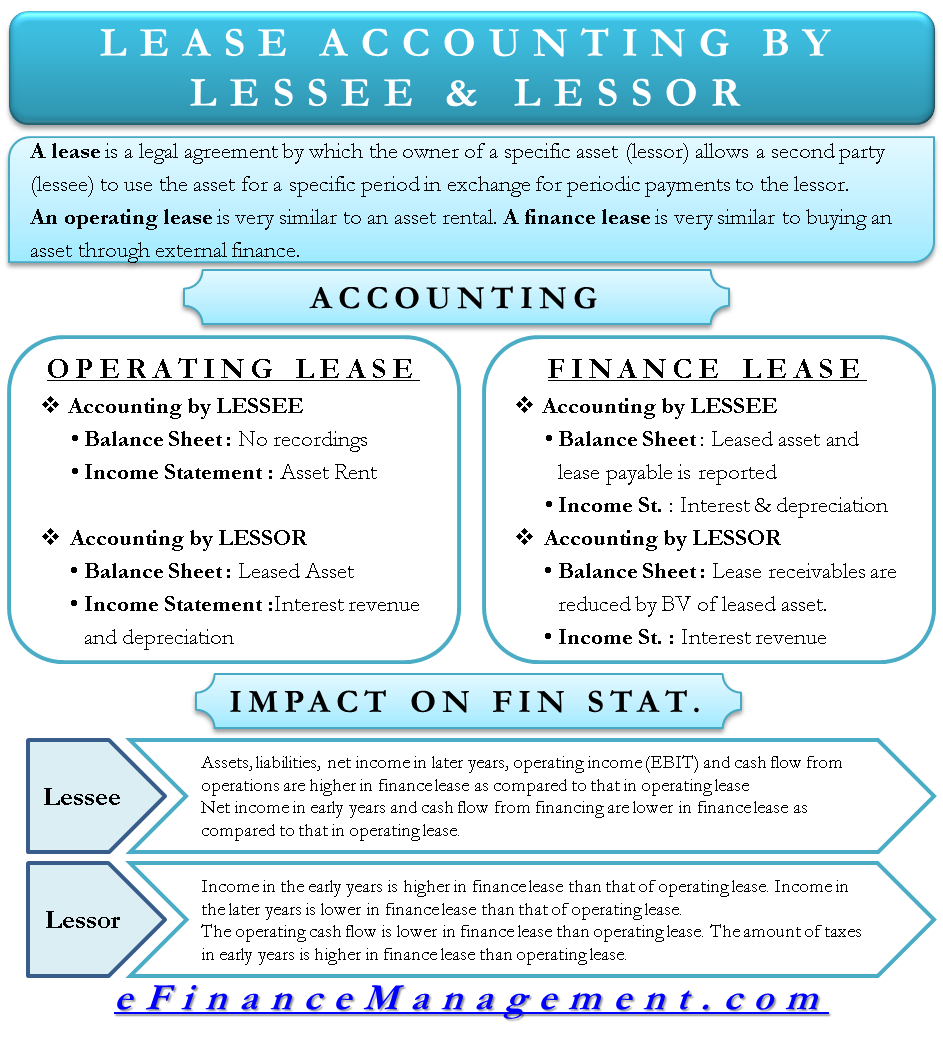

Lease Accounting Treatment By Lessee Lessor Books Ifrs Us Gaap

What Is Residual Value When You Lease A Car Credit Karma

Ind As 116 Leases Detailed Analysis

Should You Lease And Then Buy A Car Bankrate

:max_bytes(150000):strip_icc()/Short-Term_Car_Lease_GettyImages-1152293815-559b180c09644bb2985f5516d2a6a101.jpg)

:max_bytes(150000):strip_icc()/car-dealer-showing-new-car-to-young-couple-in-showroom-590778115-fd7e5fcf72564de69103e9f3db58d17f.jpg)

:max_bytes(150000):strip_icc()/when-leasing-car-better-buying-v1-735d3e7993d0435c8e1dcc0831af07bc.png)

:max_bytes(150000):strip_icc()/463652041-5bfc38f3c9e77c0026b8b3ac.jpg)

:max_bytes(150000):strip_icc()/GettyImages-912785590-bd21254b8f914ad1a28876e45800554c.jpg)

/GettyImages-1023053124-7bc6c03d72864a3486a44d768f28ccf4.jpg)

:max_bytes(150000):strip_icc()/GettyImages-960436564-1e70bdcae9fa4645af0977cd4742096b.jpg)

/GettyImages-392715-0061-5bb1340a46e0fb00269fd8cd.jpg)