iowa inheritance tax form

Law. Request for Copy of Business eFile BEN Letter 92-035.

3 11 3 Individual Income Tax Returns Internal Revenue Service

Exemptions From Iowa Inheritance Tax.

. Learn About Property Tax. A decedents net estate must be worth more than 25000 before the inheritance tax is applicable. Learn About Property Tax.

Wills for married singles widows or divorced persons with or without children. If the deceased persons net estate discussed below is worth 25000 or less no inheritance tax is due. This document is found on the website of the government of Iowa.

Wills include State Specific forms. Read more about Inheritance Tax Application for Extension of Time to File 60-027. Register for a Permit.

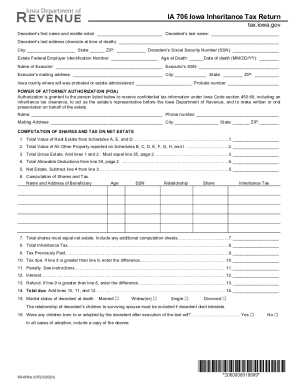

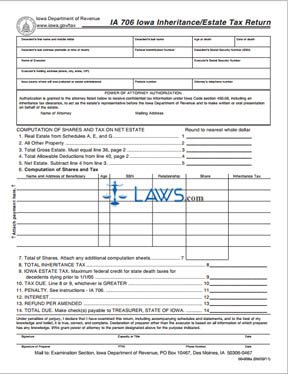

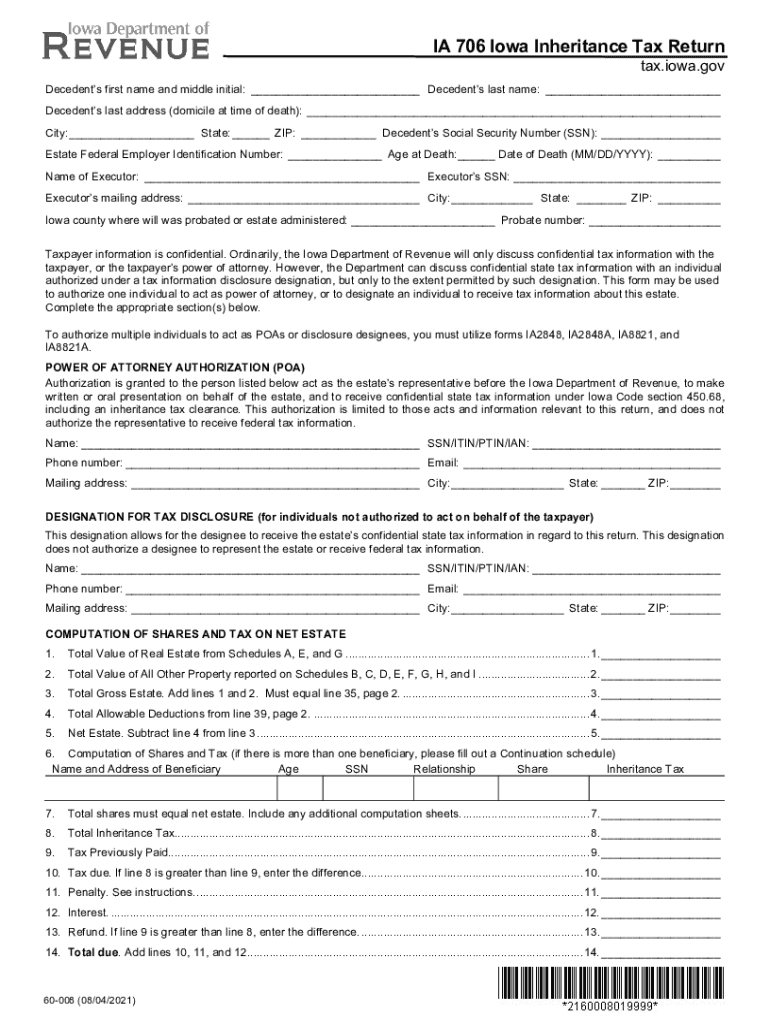

All the beneficiaries of the estate and their respective shares are included on one form IA706. Only an original inheritance tax clearance will be issued by the department. Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

Inheritance Tax Application for Extension of Time to File 60-027. An inheritance tax is only imposed against the beneficiaries that receive property or money from the decedent. Inheritance Tax Checklist 60-007.

And that individuals spouse. 1 INHERITANCETAX4501 CHAPTER450 INHERITANCETAX Referredtoin321474215942160450B1450B2450B5450B7602810263. Adopted and Filed Rules.

File a W-2 or 1099. Enter the decedents name date of death age at the time their address at the time of death and federal identification and Social Security numbers. Submit all the necessary boxes these are yellowish.

Start completing the fillable fields and carefully type in required information. Penalty Waiver Request 78-629. Choose the template you require from the library of legal form samples.

Anything that is payable to the estate upon death is not included in the calculation of inheritance tax in Iowa and anything payable to a beneficiary such as a life insurance policy is subject to the inheritance tax depending on the. Form and content - inheritance tax return. Ad Download Or Email IA 706 More Fillable Forms Register and Subscribe Now.

Aunts uncles cousins nieces and nephews of the decedent. Iowa Business Tax Change 92-033. File a W-2 or 1099.

Get 706 iowa inheritance estate tax return 2013 form signed right from your smartphone using these six tips. How Do State Estate And Inheritance Taxes Work Tax Policy Center If instead you are a sibling or other non-linear ancestor then you are subject to pay an inheritance tax on your portion. Read more about Inheritance Tax Checklist 60-007.

What is Iowa inheritance tax. An Iowa inheritance tax return must be filed if estate assets pass to both an individual listed in Iowa Code section 4509. To sign a iowa inheritance tax form 2011 right from your.

An inheritance tax return must be filed by the fiduciary of any estate when the gross share subjected to tax without reduction for liabilities of any beneficiary heir transferee or surviving joint tenant exceeds the allowable exemption from such share or if a federal return has been filed. Probate Form for use by Iowa probate attorneys only Read more about Probate Form for use by Iowa probate attorneys only Print. See the Iowa Inheritance Tax Rate Schedule Form 60-061 090611.

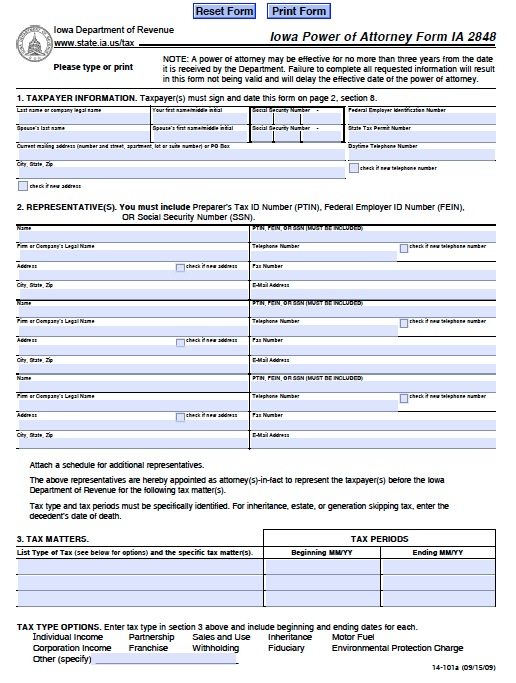

Also Mutual Wills for Married persons or persons living together. Change or Cancel a Permit. General Instructions for Iowa Inheritance Tax Return IA 706 Return Required.

Adopted and Filed Rules. 100001 plus has an. Learn About Sales.

Therefore it is necessary to first. IA 8821 Tax Information Disclosure Designation 14-104. Tax Credits.

Iowa inheritance tax is a tax paid to the State of Iowa and is based upon a persons beneficiary or heir right to receive money or property that was owned by another person decedent at the time of death and is passing from the decedent to the beneficiary or heir. Iowa InheritanceEstate Tax Return IA 706. Iowa SalesUseExcise Tax Exemption Certificate 31-014.

All Will forms may be downloaded in electronic Word or Rich Text format or you may order the form to be sent by regular mail. Learn About Property Tax. Quick steps to complete and eSign Iowa Inheritance Tax Form online.

In a matter of seconds receive an electronic document with a legally-binding e-signature. File a W-2 or 1099. Tax Credits.

Track or File Rent Reimbursement. Many close family members do not have to pay the tax. See the Iowa Inheritance Tax Rate Schedule Form 60-061 090611.

Ad Download Or Email IA 706 More Fillable Forms Register and Subscribe Now. Select the Get form key to open the document and move to editing. Passing by any method of transfer specified in Iowa Code section 4503.

Use Get Form or simply click on the template preview to open it in the editor. File a W-2 or 1099. The inheritance tax return must include a list of the property in the estate and the value of the property along with a list of liabilities or debts and deductions.

Iowa InheritanceEstate Tax Return IA 706 Step 1. Property in the Estate. Law.

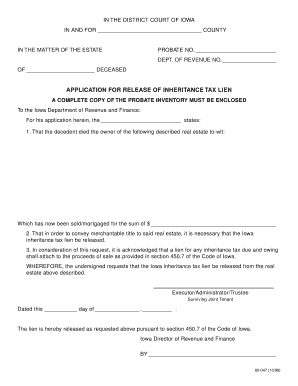

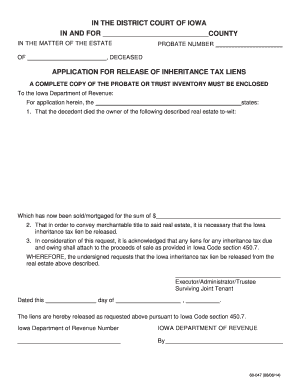

Learn About Sales. Execute Iowa InheritanceEstate Tax - Consent And Waiver Of Lien 60-014 in just a few moments by simply following the guidelines below. IA 4506 Request for Copy of Tax Return 95-504.

A full payment clearance will be issued only after the tax penalty and interest have been paid in full. Estates of decedents dying prior to July 1 1983. See the Iowa Inheritance Tax Rate Schedule Form 60-061 090611.

The personal representative is required to designate. Iowa Inheritance Tax Return. Representative Certification Form 14-108.

The document has moved here. Therefore the signNow web application is a must-have for completing and signing 706 iowa inheritance estate tax return 2013 form on the go. To pay inheritance and estate tax in the state of Iowa file a form IA 706.

The Iowa Inheritance Tax is filed using form IA706 which can be downloaded from the Iowa State Department of Revenue website at wwwiowagovtaxformsinherithtml. Rescinded IAB 101393 effective 111793. 4504 Additionally no inheritance tax return is required if the inheritors are exempt from inheritance tax.

2021 Form Ia Dor 706 Fill Online Printable Fillable Blank Pdffiller

Iowa 706 Schedule J Fill Online Printable Fillable Blank Pdffiller

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

Free Form Ia 706 Iowa Inheritance Estate Tax Return Free Legal Forms Laws Com

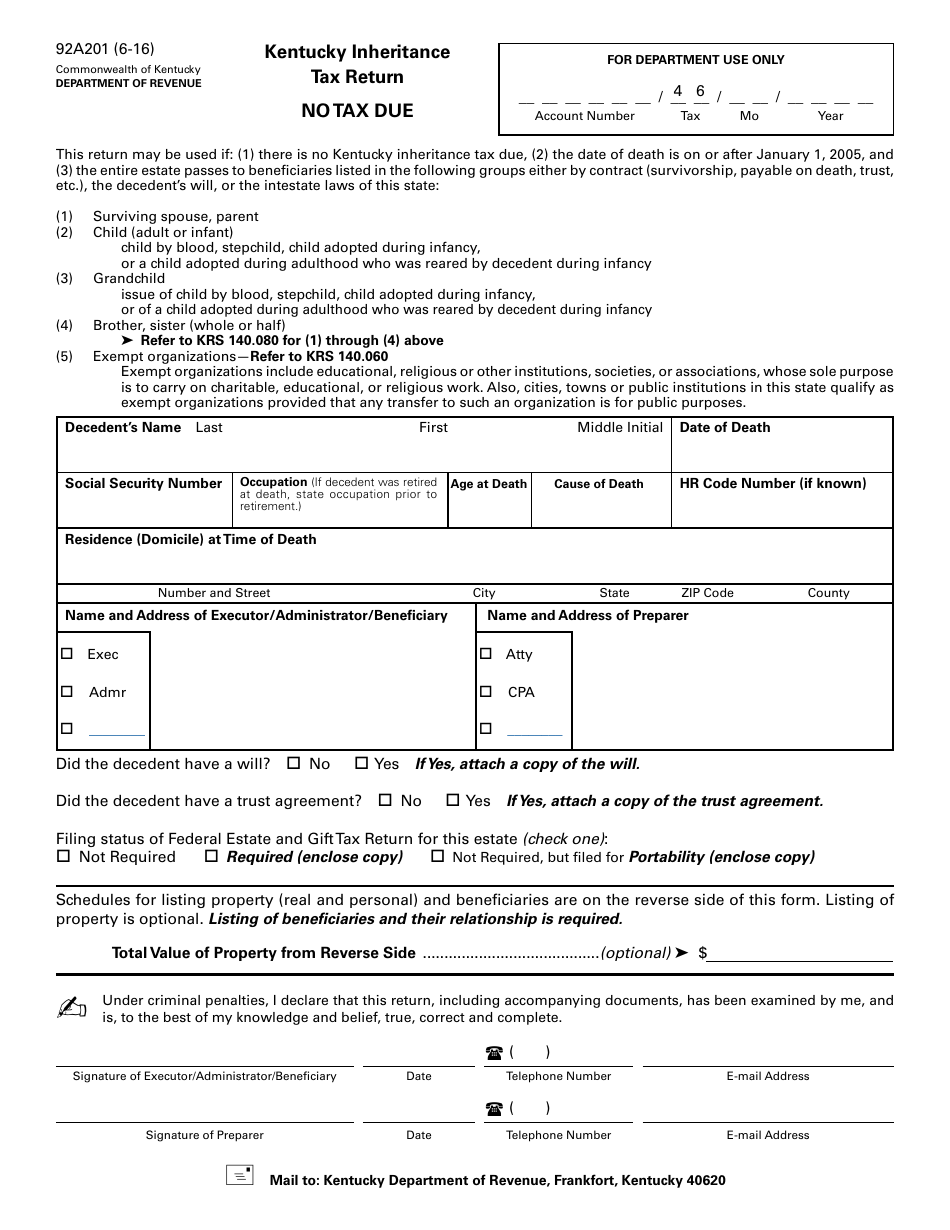

Form 92a201 Download Printable Pdf Or Fill Online Kentucky Inheritance Tax Return No Tax Due Kentucky Templateroller

Form 92a201 Download Printable Pdf Or Fill Online Kentucky Inheritance Tax Return No Tax Due Kentucky Templateroller

Fill Free Fillable Forms State Of Iowa Ocio

Free Iowa Revocable Living Trust Form Pdf Word Eforms

Free Tax Power Of Attorney Iowa Form Ia 2848 Adobe Pdf

Inheritance Release Form Fill Online Printable Fillable Blank Pdffiller

3 11 3 Individual Income Tax Returns Internal Revenue Service

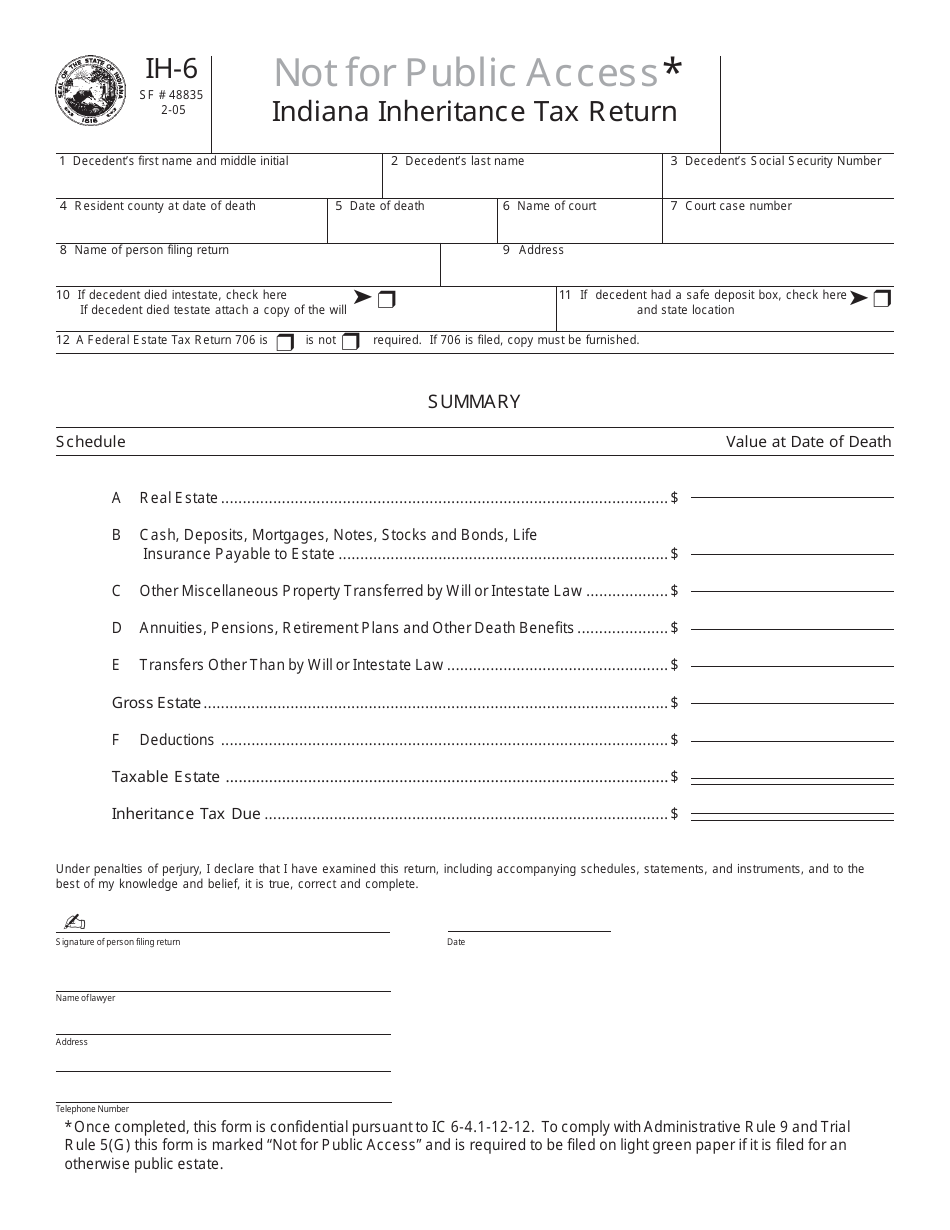

Form Ih 6 Download Fillable Pdf Or Fill Online Indiana Inheritance Tax Return Indiana Templateroller

Last Will And Testament Sample Form Free Printable Documents Last Will And Testament Will And Testament Estate Planning Checklist

Fillable Online Iowa Inheritance Application For Release Form 60 047 Fax Email Print Pdffiller

In This Article We Will Discuss The Importance Of Estate Planning After Adoption In Illinois And Adoption In Illinois Estate Planning Long Term Care Insurance

2021 Form Ia Dor 706 Fill Online Printable Fillable Blank Pdffiller

Form Ih 6 Download Fillable Pdf Or Fill Online Indiana Inheritance Tax Return Indiana Templateroller

3 11 106 Estate And Gift Tax Returns Internal Revenue Service